SomeaKenya provides Updated and Revised notes for the current CPA syllabus. Revision kits (Past papers with answers) are also available to help you with revision of the upcoming exams. You can get these materials in Hardcopies (Printed and Binded) and also available in Softcopy form when you subscribe on mobile or Desktop/Laptop someakenya Application. (Note: Softcopies are not Printable and can only be read using android phones) Click here to download SOMEAKENYA APP from Google Playstore.

Full Access to these notes/Kit on Desktop/Laptop via https://desktop.someakenya.co.ke

Or through Our Mobile App

Full Access to these notes/Kit on Desktop/Laptop via https://desktop.someakenya.co.ke

Or through Our Mobile App

CONTENT

1. Introduction to Public Financial Management

Table of Contents

• Nature and scope of public finance

• Sources of public finance

• Objectives of the Public Financial Management Act and Financial regulations

• Budget process for national, county and public entities, Development plan preparation, Treasury circulars, Cash flow projections, Budget estimates and revenue raising measures.

• Role of the National Treasury and County Treasuries with respect to the management and control of public finance.

2. Relationship between National and County Governments on budget and economic matters

• The process of sharing revenue between national and county governments and among the county governments: Factors considered and formula used

• Division of revenue bill and county allocation of revenue bill

• The role of the Commission on Revenue on Allocation (COR)

• The role of the Council of Governors in county financial management

• National Government public funds: The Consolidated Fund; The Contingency fund; The Equalisation fund and Other National Government public funds

• County Government public funds; County Revenue Fund; County Government Emergency Funds and other county public funds

• County government revenue sources.

3. Oversight Function in Public Finance Management

• The role of National Assembly: Responsibilities of the National Assembly budget committee in public finance matters

• The role of Senate: Responsibilities of the Senate budget committee in public finance matters

• The role of Parliamentary Budget Office

• The role of Auditor General

• The role of Internal Audit

• Role of Controller of Budget

• The role of public sector accounting standards board

4. Procurement in public entities

• Introduction to Public Procurement and Disposal (PPD) Act

• Procurement guidelines as envisaged by PPD Act

• Procurement process by National, County and other public entities: The role of the National Treasury, Public Procurement Regulatory Authority and Public Procurement Administrative Review Board

• Tendering process and selection of suppliers in public sector

• Concept of e-procurement

5. Public Private Partnerships Arrangements

• Rationale and justification for Public Private Partnerships

• Establishment of Public Private Partnerships (PPP) Unit in the National Treasury

• Contract/project agreements, guidelines and standards

• Composition and role of PPP petition committee

• Establishment and role of PPP project facilitation fund

6. Public Debt Management

• Establishment of debt management office

• Objectives of debt management in public sector

• Sources of public debt in Kenya

• Management of debts by county governments and other public entities

• Role of the Cabinet Secretary of the National Treasury in public debt management

• Measures that can be adopted to reduce public debt

7. Introduction to Taxation

• Definition of Tax, Taxation and Types of taxes in Kenya

• History of taxation

• Classification of taxes; Tax shifting and Factors that determine tax shifting

• Principles of an optimal tax system

• Types of tax systems; Single versus multiple tax systems

• Purposes of taxation/Why the government levy taxes

• Tax evasion and tax avoidance

• Taxable capacity

• Budgetary and Fiscal policies

• The Revenue Authority; Structure, Functions, Large and Medium Taxpayers Office mandate

8. Taxation of Income

• Introduction

o Basis of charging tax in Kenya: Section 3 of the Income Tax Act

o Concept of residency and Criteria of taxing income in Kenya.

o Taxable and non-taxable persons

o Specified Sources of income

o Incomes exempted from taxation

• Taxation of Employment income

o Taxable cash and non-cash benefits/rewards received from employment

o Non-taxable cash and non-cash benefits/rewards received from employment

o Allowable deductions against employment income

o Tax credits (withholding tax, personal and insurance relief, others)

o Taxation of lumpsum payment for services rendered and services that would have been rendered; Gratuity, terminal dues, compensation for loss of office.

o Operations of PAYE systems: Preparation of PAYE returns, categories of employees, multiple sources of income, irregularly paid employees, casual workers, PAYE audit and triggers

o Other Statutory deductions (NSSF and NHIF)

o All these should be illustrated with relevant computations including PAYE computations

• Taxation of Business Income

o Introduction to taxation of business income including criteria of taxing business income

o Income Tax Act provisions on computation of business income

o Allowable and disallowable business expenses and taxable business income

o Taxable business income and tax payable computations in respect of:

Sole proprietorship

Partnerships (excluding admissions, retirement of partners and conversions)

Incorporated entities (excluding specialised institutions)

o Taxation of rental income and royalties

o Taxation of Farming income

o Taxation of Investment income (Dividend and interest income)

o Turnover tax and Minimal tax

o Taxation of Capital gains

o Taxation of Digital income; digital service tax and Digital service tax agents

o Withholding Tax

Income subject to withholding tax (Dividends, Interest, management and profession fees, royalties)

Withholding Tax Rates on Residents and non-residents

Introduction to Double Tax Agreements and the impact on withholding tax payments

All the above should be illustrated with relevant basic computations.

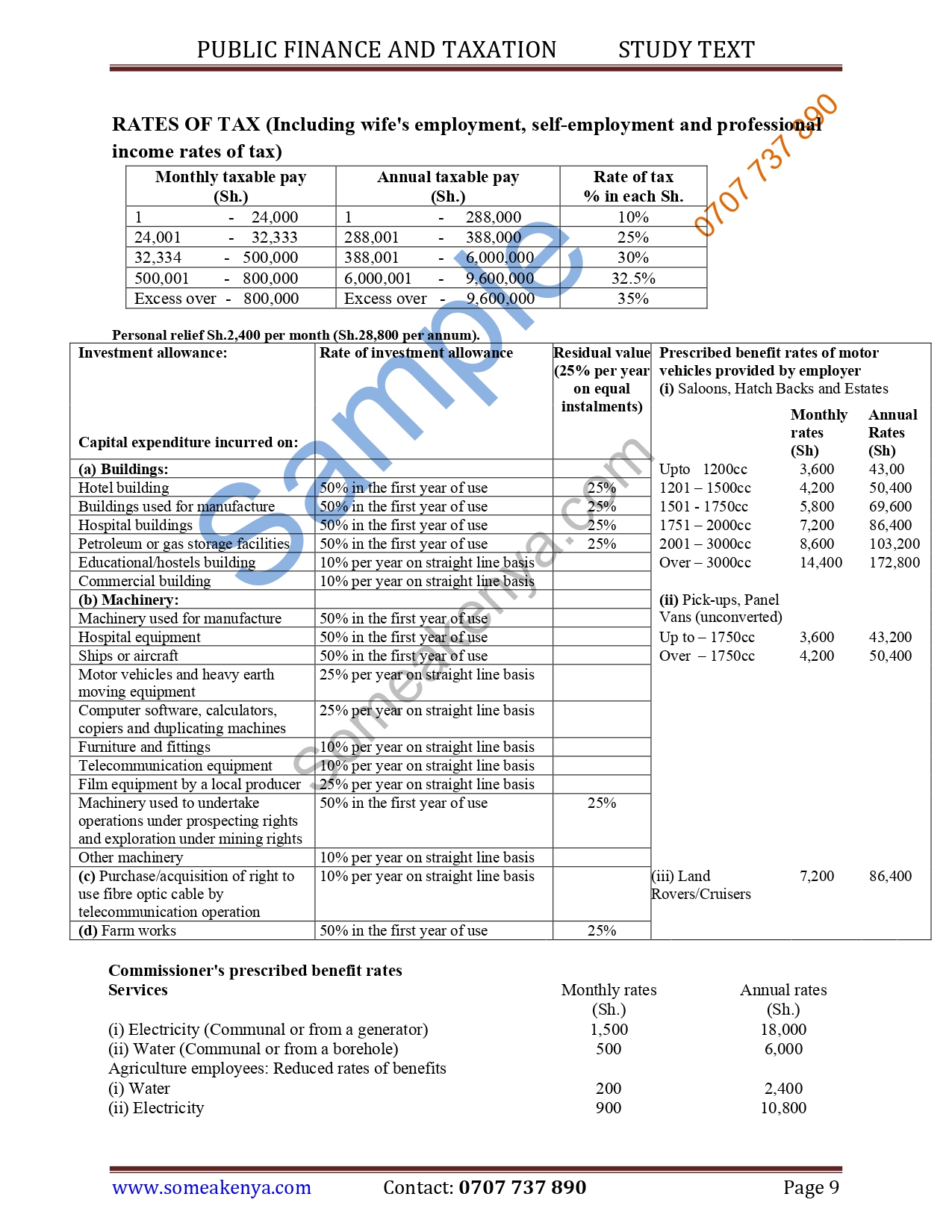

9. Investment Allowances/deductions

• Introduction to capital allowances and Rationale for capital deductions

• Types of capital allowances; Theory and computations

• Investment deductions; Ordinary manufacturers

• Industrial building deductions

• Wear and tear allowances

• Farm works deductions

• Shipping investment deduction

• Other deductions

All the above should be illustrated with relevant computations

10. Administration of Income Tax and Tax Procedures

• Registration and deregistration of tax payers

• Personal identification number: Issue, uses, cancellation of a PIN

• Taxpayer’s tax representative: Appointment, liabilities and obligations

• Tax Returns and Assessments: Self-assessment,Default assessment, Advance assessment,Amendment of assessments

• Collection, recovery and refund of taxes

• Tax Decisions, Objections, Appeals and Relief of mistakes

• Voluntary Tax Disclosure Program

• Administrative penalties and offences

• Application of ICT in taxation: Practical use of iTax to file the returns

11. Administration of Value Added Tax (VAT)

• Introduction to VAT, Basis of charging VAT and VAT rates

• Rights and obligations of VAT taxable person

• Registration and deregistration of businesses for VAT

• Key terms in VAT: Input tax, Output tax, Supply, Time of supply/Tax point and Taxable value of a supply/Value for VAT supported with relevant calculations

• Deduction of input tax

• Accounting for VAT and VAT records

• Taxable and non-taxable supplies: Zero rated supplies, Exempt goods and exempt services including restriction of input tax claim.

• Privileged persons and institutions

• Withholding VAT and withholding VAT agents

• VAT returns and assessments including VAT Auto Assessments

• Remission, rebate and refund of VAT

• Changes to be notified to the commissioner

• Offences, fines, penalties and interest

12. Customs Taxes and Excise Taxes

• Purpose of customs and excise duties

• Imposition of customs duty

• Customs procedure

• Bonded warehouse and bond securities

• Goods subject to customs control

• Refund of duty

• The Simba System/Integrated Customs Management System

• Imposition of excise duty

• Excisable goods under excise control

• Application for excise duty (licensing), issue of licences, Suspension and Cancellation of Licences

• Excise stamps and Excisable goods management system

• Refund of excise duty

• Excise duty returns and payments

• Offences and penalties

13. Miscellaneous fees and levies

• Export levy

• Import Declaration fee (IDF)

• Railway Development Levy (RDL)

• Stamp duty

• Catering levy

• Motor vehicle advance tax

• Betting, Lotteries & Gaming taxes

TOPIC 1

INTRODUCTION TO PUBLIC FINANCIAL MANAGEMENT

NATURE AND SCOPE OF PUBLIC FINANCE

What is Public Finance?

The word public refers to general people and the word finance means resources. So public finance means resources of the masses, how they are collected and utilized.

Different economists have defined public finance differently. Some of the definitions are given below.

1. According to prof. Dalton public finance is one of those subjects that lie on the border lie between economics and politics. He says, “Public finance is concerned with the income and expenditure of public authorities, and with the adjustment of the one to the other.“

2. According to Adam Smith “public finance is an investigation into the nature and principles of the state revenue and expenditure”

3. According to Findlay Shirras “Public finance is the study of principles underlying the spending and raising of funds by public authorities”.

4. According to H.L Lutz “Public finance deals with the provision, custody and disbursement of resources needed for conduct of public or government function.”

Thus, Public Finance is seen as a branch of economics which studies income and expenditure of government.

The discipline of public finance describes and analyses government services, subsidies and welfare payments, and the methods by which the expenditures to these ends are covered through taxation, borrowing, foreign aid and the creation of money.

NATURE OF PUBLIC FINANCE

Public finance is a science as well as an art. Science is the systematic study of any subject which studies relationship between facts while, In the words of J.N. Keynes, ”Art is the application of knowledge for achieving definite objectives.”

It is a science because we study in it the various principles, problems and policies underlying the spending and raising of funds by the public authorities. It teaches how to collect taxes in the best way and how to maintain them economically and how to spend them properly.

Carl Copping Plehn (January 20, 1867 – July 21, 1945) an American economist and a professor of public finance at the University of California, Berkeley, from 1893 to 1937 advanced the following arguments in favour of public finance being science:

One. Public finance is not a complete knowledge about human rather it is concerned with definite and limited field of human knowledge.

Two. Public finance is a systematic study of the facts and principles relating to government revenue and expenditure.

Three. Scientific methods are used to study public finance.

Four. Principles of public finance are empirical.

As an art, public finance enables the concerned personnel to adopt the principles and policies in solving the financial problems of the Government in the best possible way to the maximum benefit of the society. The way to be adopted should be logical, suitable and proper according to the time. Application of various principles and policies depends much on the ability of the personnel in the Government how best he can extract from it in the public interest.

Public finance is therefore, both a science and an art. This can either be;

1) Positive science, as well as

2) Normative science.

It is a positive science as by the study of public finance factual information about the problems of government’s revenue and expenditure can be known. It also offers suggestions in this respect.

It is also normative science as study of public finance presents norms or standards of the government’s financial operations. It reveals what should be the quantum of taxes, kind of taxes and on what items less of public expenditure can be incurred.

SCOPE OF PUBLIC FINANCE

Public finance as a subject, which studies the income and expenditure of the government, its scope may be summarised in five (5) broad ways as follows:

1. Public Revenue

2. Public Expenditure

3. Public Debt

4. Financial Administration

5. Economic Stabilization

1. Public Revenue: Public revenue concentrates on the methods of raising public revenue, the principles of taxation and its problems. It further studies the classification of various resources of public revenue into taxes, fees and assessment etc.

2. Public Expenditure: This part studies the fundamental principles that govern the flow of Government funds into various streams.

3. Public Debt: This section is concerned with, the problem of raising loans. The loan raised by the government in a particular year is the part of public revenue.

4. Financial Administration: This refers to the organisation and administration of the financial mechanism of the Government by relevant Government machinery.

5. Economic Stabilization: This part describes the various economic policies and other measures of the government to bring about economic stability in the country.

The subject-matter of public finance is not static, but dynamic. As the economic and social responsibilities of the state are increasing day by day, the methods and techniques of raising public income, public expenditure and public borrowings are also changing.

SOURCES OF PUBLIC FINANCE

Sources of government revenue

• Taxes – these include Income Tax, Customs Duty and Value Added Tax.

• Trade licenses.

• Loans from World Bank and International Monetary Fund. These have to be repaid with interest.

• Aid and grants from friendly countries. These are some form of gifts and do not need to be paid back.

• Interest on government loans.

• Rent paid by people occupying government houses and offices.

• Court fines.

• Dividends from shares bought by the government in profitable companies.

• Rates paid by people who own property in urban areas.

• Profits made by parastatal organisations.

• Those in the tourism business pay some taxes to the bank.

• Export from Kenya are sold earning the country income.

• Profits earned on government loans

• Profits made from sale of government property.

• Money made from government institutions.

OBJECTIVES OF THE PUBLIC FINANCIAL MANAGEMENT ACT AND FINANCIAL REGULATIONS

Objectives of Public Finance Management Act, 2012

1. Promote good financial management at the National and County Government level

2. Facilitate effective and efficient use of limited resources

3. Have one overarching legislation applied to both levels of governments instead of several PFM laws as was the case before.

4. Comply with constitutional requirement to enact legislations on public finance listed in the 5th schedule and also mentioned in Chapter 12

FINANCIAL REGULATIONS

The national treasury will manage the national government’s public finances in accordance with the constitution and the principles of fiscal responsibility set out below:

• Over the medium-term, a minimum of thirty percent of the national and county government’s budgets shall be allocated to the development expenditure;

• The national government’s expenditure on wages and benefits for its public officers shall not exceed a percentage of the national government revenue as prescribed by regulations;

• Over the medium-term, the national government’s borrowings shall be used only for the purpose of financing development expenditure.

• Public debt and obligations shall be managed at a sustainable level as approved by parliament for the national government and the county assembly for the county government.

• Fiscal risks shall be managed prudently; and

• A reasonable degree of predictability with respect to the level of tax rates and tax bases shall be maintained taking into account any tax reforms that may be made in the future.

Short-term borrowing shall be restricted to management of cash flows and in case of a bank overdraft facility it shall not exceed five percent of the most recent audited national government revenue.

The national treasury shall ensure that the level of national debt does not exceed the level specified annually in the medium-term national government debt management strategy submitted to parliament.

BUDGET PROCESS FOR NATIONAL, COUNTY AND PUBLIC ENTITIES, DEVELOPMENT PLAN PREPARATION, TREASURY CIRCULARS, CASH FLOW PROJECTIONS, BUDGET ESTIMATES AND REVENUE RAISING MEASURES

BUDGET PROCESS FOR NATIONAL, COUNTY AND PUBLIC ENTITIES

National Government Budget Process

The National Budget Process is outlined under Part III of the Public Finance Management Act 2012 (PFM), and it provides in Section 35 (1) of the Act that, the budget process for the national government in any financial year comprises of the following stages: –

1. Integrated development planning process which includes both long term and medium-term planning;

2. Planning and determining financial and economic policies and priorities at the national level over the medium term;

3. Preparing overall estimates in the form of the Budget Policy Statement of national government revenues and expenditures;

4. Adoption of Budget Policy Statement by Parliament as a basis for future deliberations;

5. Preparing budget estimates for the national government;

6. Submitting those estimates to the National Assembly for approval;

7. Enacting the appropriation Bill and any other Bills required to implement the National government’s budgetary proposals;

8. Implementing the approved budget;

9. Evaluating and accounting for, the national government’s budgeted revenues and expenditures; and

10. Reviewing and reporting on those budgeted revenues and expenditures every three months.

County Government Budget Process

The County Budget Process is outlined under Part IV of the Public Finance Management Act 2012 (PFM), and it provides in Section 125 (1) of the Act that, the budget process for the county governments in any financial year shall comprise the following stages: –

1. Integrated development planning process which shall include both long term and medium-term planning;

2. Planning and establishing financial and economic priorities for the county over the medium term;

3. Making an overall estimation of the county government’s revenues and expenditures;

4. Adoption of County Fiscal Strategy Paper;

5. Preparing budget estimates for the county government and submitting estimates to the county assembly;

6. Approving of the estimates by the county assembly;

7. Enacting an appropriation law and any other laws required to implement the county government’s budget;

8. Implementing the county government’s budget; and

9. Accounting for, and evaluating, the county government’s budgeted revenues and expenditures;

The Cabinet Secretary & The County Executive Committee member for finance MUST ensure that there is public participation in the budget process.

TREASURY CIRCULARS

Treasury circulars provide guidance and instructional information principally to government departments and state-owned enterprises and request financial information from those agencies. They are usually addressed to :

• Chief executives (CEs);

• Chief Financial Officers (CFOs);

Application

– The main purpose of Treasury circulars is to provide guidance & instructional information and to request for financial information.

– Treasury circulars may also cover matter which are outside the scope of treasury instructions such a budget timetable.

– Treasury circulars may also cover matters that are to take effect immediately (but these may be incorporated within treasury instructions as part of an annual update)

Chapter 12 & Sec. 104 of the PFM Act allows both the National and County Treasuries to issue Treasury Circulars (See sample below)

CASH FLOW PROJECTIONS

Not later than the 15th June of each financial year, every county government shall prepare an annual cash flow projection for the county for the next financial year, and submit the cash flow projection to the Controller of Budget with copies to the Intergovernmental Budget and Economic Council and the National Treasury.

Regulations shall prescribe the format and content of the annual cash flow projections.

DEVELOPMENT PLAN PREPARATION

The budget process for county governments in any financial year shall consist of the following stages—

1. integrated development planning process which shall include both long term and medium term planning;

2. planning and establishing financial and economic priorities for the county over the medium term;

3. making an overall estimation of the county government’s revenues and expenditures;

4. adoption of County Fiscal Strategy Paper;

5. preparing budget estimates for the county government and submitting estimates to the county assembly;

6. approving of the estimates by the county assembly;

7. enacting an appropriation law and any other laws required to implement the county government’s budget;

8. implementing the county government’s budget; and

9. accounting for, and evaluating, the county government’s budgeted revenues and expenditures;

The County Executive Committee member for finance shall ensure that there is public participation in the budget process.

County government to prepare development plan

Every county government shall prepare a development plan in accordance with Article 220(2) of the Constitution, that includes—

a. strategic priorities for the medium term that reflect the county government’s priorities and plans;

b. a description of how the county government is responding to changes in the financial and economic environment;

c. programmes to be delivered with details for each programme of—

i. the strategic priorities to which the programme will contribute;

ii. the services or goods to be provided;

iii. measurable indicators of performance where feasible; and

iv. the budget allocated to the programme;

d. payments to be made on behalf of the county government, including details of any grants, benefits and subsidies that are to be paid;

e. a description of significant capital developments;

f. a detailed description of proposals with respect to the development of physical, intellectual, human and other resources of the county, including measurable indicators where those are feasible;

g. a summary budget in the format required by regulations; and (h) such other matters as may be required by the Constitution or this Act.

The County Executive Committee member responsible for planning shall prepare the development plan in accordance with the format prescribed by regulations.

The County Executive Committee member responsible for planning shall, not later than the 1st September in each year, submit the development plan to the county assembly for its approval, and send a copy to the Commission on Revenue Allocation and the National Treasury.

The County Executive Committee member responsible for planning shall publish and publicise the annual development plan within seven days after its submission to the county assembly.

ROLE OF THE NATIONAL TREASURY AND COUNTY TREASURIES WITH RESPECT TO THE MANAGEMENT AND CONTROL OF PUBLIC FINANCE

Role of the National Treasury

The National Treasury derives its mandate from Article 225 of the Constitution 2010, Section 11 of the Public Management Act 2012 and the Executive order No. 2/2013. It executes its mandate in consistency with any other legislation as may be developed or reviewed by Parliament from time to time.

The core functions of the National Treasury as derived from the above legal provisions include;

1. Formulate, implement and monitor macro-economic policies involving expenditure and revenue;

2. Manage the level and composition of national public debt, national guarantees and other financial obligations of national government;

3. Formulate, evaluate and promote economic and financial policies that facilitate social and economic development in conjunction with other national government entities;

4. Mobilize domestic and external resources for financing national and county government budgetary requirements;

5. Design and prescribe an efficient financial management system for the national and county governments to ensure transparent financial management and standard financial reporting;

6. In consultation with the Accounting Standards Board, ensure that uniform accounting standards are applied by the national government and its entities;

7. Develop policy for the establishment, management, operation and winding up of public funds;

8. Prepare the annual Division of Revenue Bill and the County Allocation of Revenue Bill;

9. Strengthen financial and fiscal relations between the national government and county governments and encourage support for county governments and assist county governments to develop their capacity for efficient, effective and transparent financial management; and

10. Prepare the National Budget, execute/implement and control approved budgetary resources to MDAs and other Government agencies/entities.

Responsibility of National Treasury with Respect to Public Funds

• The National Treasury is responsible to administer the Consolidated Fund.

• The National Treasury is responsible to administer the Equalisation Fund.

• Cabinet Secretary is responsible to administer the Contingencies Fund.

• Cabinet Secretary is responsible to seek Parliamentary approval for payments made from Contingencies Fund.

Role of the County Treasuries

The County Treasuries are established pursuant to Section 103 of the Public Management Act 2012 for each county government. The County Treasury comprise of:

• The County Executive Committee member for finance; (Head of the County Treasury)

• The Chief Officer; and

• The department or departments of the County Treasury responsible for financial and fiscal matters.

The core function of a County Treasury is to monitor, evaluate and oversee the management of public finances and economic affairs of the county government including:

1. Developing and implementing financial and economic policies in the county;

2. Preparing the annual budget for the county and co- ordinating the preparation of estimates of revenue and expenditure of the county government;

3. Co-coordinating the implementation of the budget of the county government;

4. Mobilizing resources for funding the budgetary requirements of the county government and putting in place mechanisms to raise revenue and resources;

5. Managing the county government’s public debt and other obligations and developing a framework of debt control for the county;

6. Consolidating the annual appropriation accounts and other financial statements of the county in a format determined by the Accounting Standards Board;

7. Acting as custodian of the inventory of the county government’s assets except where provided otherwise by other legislation or the Constitution;

8. Ensuring compliance with accounting standards prescribed and published by the Accounting Standards Board from time to time;

9. Ensuring proper management and control of, and accounting for the finances of the county government and its entities in order to promote efficient and effective use of the county’s budgetary resources;

10. maintaining proper accounts and other records in respect of the County Revenue Fund, the County Emergencies Fund and other public funds administered by the county government;

11. Monitoring the county government’s entities to ensure compliance with this Act and effective management of their funds, efficiency and transparency and, in particular, proper accountability for the expenditure of those funds;

12. Assisting county government entities in developing their capacity for efficient, effective and transparent financial management, upon request;

13. Providing the National Treasury with information which it may require to carry out its responsibilities under the Constitution and this Act;

14. Issuing circulars with respect to financial matters relating to county government entities;

15. Advising the county government entities, the County Executive Committee and the county assembly on financial matters;

16. Strengthening financial and fiscal relations between the national government and county governments in performing their functions;

17. Reporting regularly to the county assembly on the implementation of the annual county budget; and

18. Taking any other action to further the implementation of this Act in relation to the county.

Responsibility of County Treasury with Respect to Public Funds

• The County Treasury for each county government shall ensure that all money raised or received by or on behalf of the county government is paid into the established County Revenue Fund.

• County Government Executive Committee may establish county government Emergency Fund.

• County Executive Committee member for finance is responsible for administering the Emergency Fund

• County Executive Committee member for finance has the responsibility to seek approval for payments from Emergency Fund from the county assembly.

• County Treasury is to submit a report to Auditor-General in respect to Emergency Fund

• County Treasury is responsible for preparing County Fiscal Strategy Paper.

• County Treasury responsible for preparing a County Budget Review and Outlook Paper.

TOPIC 2

RELATIONSHIP BETWEEN NATIONAL AND COUNTY GOVERNMENTS ON BUDGET AND ECONOMIC MATTERS

THE PROCESS OF SHARING REVENUE BETWEEN NATIONAL AND COUNTY GOVERNMENTS AND AMONG THE COUNTY GOVERNMENTS: FACTORS CONSIDERED AND FORMULA USED

Process of Sharing Revenue

The process of sharing revenue raised by the national government between the national and county governments, and among the county governments, shall be in accordance with the Constitution and the PFM Act.

Factors Considered and Formula Used

Article 203 details the conditions taken into account in determining equitable share of national Revenue from national to county government

1. National interest

2. Public debt

3. Needs of the national government

4. Need to ensure county governments can perform tasks required of them

5. Fiscal capacity of county governments

6. Developmental needs of the counties

7. Economic disparities in the counties

8. Affirmative action in respect of disadvantaged areas and people

9. Stability and predictability in allocation of revenue

10. Flexibility in responding to emergencies

Every fiscal year the minimum revenue allocated to county governments will be 15% of revenues collected by national government.

DIVISION OF REVENUE BILL OR COUNTY ALLOCATION OF REVENUE

Each year when the Budget Policy Statement is introduced, the Cabinet Secretary shall submit to Parliament a Division of Revenue Bill and County Allocation of Revenue Bill prepared by the National Treasury as provided in PFM Act for the financial year to which that Budget relates.

The Division of Revenue Bill is a bill introduced in parliament to provide for the equitable division of revenue raised nationally between the national and county governments in the relevant financial year, and for connected purpose.

The County Allocation of Revenue Bill specifies the following;

(a) Each county’s share of the revenue.

(b) Any other allocations to the counties, from the national government’s share of that revenue, and any conditions on which those allocations shall be made.

Before the submission of the Division of Revenue Bill and County Allocation of Revenue Bill, the Cabinet Secretary shall notify;

(a) The Intergovernmental Budget and Economic Council; and

(b) The Commission on Revenue Allocation.

When the Division of Revenue Bill or County Allocation of Revenue Bill is submitted, it shall be accompanied by a memorandum which explains—

1. How the Bill takes into account the criteria listed in the Constitution.

2. The extent of the deviation from the Commission on Revenue Allocation’s recommendations.

3. The extent, if any, of deviation from the recommendations of the Intergovernmental Budget and Economic Council.

4. Any assumptions and formulae used in arriving at the respective shares.

THE ROLE OF COMMISSION ON REVENUE ALLOCATION (COR)

Article 215 of the Constitution establishes the Commission on Revenue Allocation (CRA) which comprises of the following persons;

• Chairperson nominated by the President and approved by the National Assembly

• Two persons nominated by political parties represented in the National Assembly

• Five persons nominated by the political parties represented in the Senate Principal secretary responsible for finance

Functions of the commission on Revenue allocation

• The major function of the Commission is to make recommendations concerning the basis for the equitable sharing of revenue raised by the national government between the national and county governments; and among the county governments.

• To recommend on matters concerning the financing of both the national government and county governments.

• To recommend on matters concerning the financial management of both national and county governments.

• Define and enhance revenue sources of the national government.

• Define and enhance revenue sources of county governments.

• Encourage fiscal responsibility by the national government.

• Parliament should consult CRA and consider CRA’s recommendations before passing any Bill appropriating money out of the Equalization Fund.

• To encourage fiscal responsibility by county governments.

• To advice Parliament on any Bill that includes provisions dealing with sharing of revenue.

• Advice on any Bill that includes provisions dealing with any financial matter concerning county governments.

• To publish and review the policy that sets out criteria for identifying marginalized areas in the actualization of the Equalization Fund

• To be consulted and its’ recommendations considered by Parliament for all laws being enacted relating to devolved government.

• To make recommendations to the Senate when determining the basis for allocating among the counties the share of national revenue that is annually allocated to the county level of government

THE ROLE OF THE COUNCIL OF GOVERNORS IN COUNTY FINANCIAL MANAGEMENT

The Council of Governors (COG) is a body established under the Intergovernmental Relations Act. This is a body consisting of the elected governors of the 47 counties.

The Council of Governors should elect a chairperson and vice-chairperson from among its members. The two should serve for a term of one year and are eligible for re-election for one further term of a year.

The functions of the Council of Governors

The Council should provide a forum for—

• consultation among county governments;

• sharing of information on the performance of the counties in the execution of their functions with the objective of learning and promotion of best practice and where necessary, initiating preventive or corrective action;

• considering matters of common interest to county governments;

• dispute resolution between counties within the framework provided under the Intergovernmental Relations Act;

• facilitating capacity building for governors;

• receiving reports and monitoring the implementation of inter-county agreements on inter-county projects;

• consideration of matters referred to the Council by a member of the public;

• consideration of reports from other intergovernmental forums on matters affecting national and county interests or relating to the performance of counties; and

• performing any other function that the Intergovernmental Relations Act may confer to it or any other legislation or that it may consider necessary or appropriate.

The Council of Governors has the power to establish other intergovernmental forums including inter-city and municipality forums.

NATIONAL GOVERNMENT PUBLIC FUNDS: THE CONSOLIDATED FUND; THE CONTINGENCY FUND; THE EQUALISATION FUND AND OTHER NATIONAL GOVERNMENT PUBLIC FUNDS

Provision of Establishing Public Funds

These are government entities created by the Constitution for particular purposes and are separately organised from other financial obligations of the government with capability to hold their Assets and Liabilities separately.

They engage in financial transactions on their own account. Their sources of finance are:

• Provided for by law

• Transfer from budget

• User Charges

• Borrowing or Donor funds

Rationale of Creation of Public Funds

There are three major reasons behind the necessity to create public funds. These are:

• Budget failure to address specific needs that may require more attention.

• Failure by the budget to fully or adequately fund some activities.

• Protection of important programs from budget cuts.

THE CONSOLIDATED FUND

Establishment: Article 206 (1) of the constitution establishes the Consolidated Fund. The fund receives all money raised or received by or on behalf of the national government, except : –

• Money reasonably excluded from the Fund by an Act of Parliament and payable into another public fund established for a specific purpose; or

• Money retained by the State organ that received it for the purpose of defraying the expenses of the State organ.

Withdrawal from the Fund: Money can only be withdrawn from the Consolidated Fund under the following conditions: –

1. Accordance to an appropriation by an Act of Parliament (Appropriation Act);

2. Accordance with Article 222 (Authorise before Appropriation Act is passed) or 223 (Supplementary Appropriation); or

3. As a charge against the Fund as authorized by the Constitution or an Act of Parliament.

Administration of the Fund: According to Sec. 17 (1) of the PFM Act, 2012, The National Treasury is mandated to administer the Consolidated Fund and to maintain the Consolidated Fund in the National Exchequer Account, kept at the Central Bank of Kenya.

The National Treasury does the following in carrying out its duty as the Fund’s administrator: –

• Facilitates payments into that account all money raised or received by or on behalf of the national government; and

• Pays from that National Exchequer Account without undue delay all amounts that are payable for public services.

• Ensures that the Exchequer Account is NOT overdrawn at any time.

For every withdrawal, the Treasury MUST make a requisition and submit it to the Controller of Budget for approval. The approval, together with written instructions from the Treasury is sufficient authority for the CBK to pay.

CONTINGENCY FUNDS

The Establishment and Administration of Contingency Funds

Establishment: Article 208 (1) of the constitution establishes Contingencies Fund. The Fund consists of monies appropriated from the Consolidated Fund for urgent & unforeseen need.

Administration of the Fund: The Cabinet Secretary is the administer of the Fund and should ensure that the Permanent capital of the Fund doesn’t exceed 10B or as may be prescribed by the Cabinet Secretary with the approval of Parliament.

The Cabinet Secretary keeps the Fund in a separate account, maintained at CBK and can only pay: –

• Into that account monies appropriated to the Contingencies Fund by an Appropriation Act; and

• From the Contingencies Fund, without undue delay, all advances made.

Advances from the Fund: This can only be done in case of urgent & unforeseen need. There is an urgent need for expenditure if the Cabinet Secretary, guided by regulations and relevant laws, establishes that: –

• The payment was not budgeted for; and

• The event was unforeseen and cannot be delayed until a later financial year

Without harming the general public interest. An unforeseen event is one which

i) Threatens serious damage to human life or welfare;

ii) Threatens serious damage to the environment; and

iii) Is meant to alleviate the damage, loss, hardship or suffering caused directly by the event. An event is considered to threaten damage to human life or welfare only if it involves causes or may cause: –

a) Loss of life, human illness or injury;

b) Homelessness or damage to property;

c) Disruption of food, water or shelter; or

d) Disruption to services, including health services

Financial statements in respect of the Fund: Within three months after the end of each financial year, the National Treasury MUST prepare and submit to the Auditor-General financial statements for that year which should contain the following information: –

EQUALIZATION FUNDS

The Establishment and Administration of Equalization Funds

Establishment: Article 204 (1) of the constitution establishes the Equalization Fund and allocated to it 0.5% of all the revenue collected by the National Government each year. Total revenue is calculated on the basis of the most recent audited accounts of revenue received, as approved by the National Assembly.

Purpose of the Fund: The National Government uses the Equalization Fund only to provide basic services to marginalized areas to the extent necessary to bring the quality of those services in those areas to the level generally enjoyed by the rest of the nation. These services include:

• Water;

• Roads;

• Health facilities; and

• Electricity.

Withdrawal from the Fund: The National Government may use the Equalization Fund under the following conditions: –

1. In accordance with an Appropriation Act; and

2. Either directly, or indirectly through conditional grants to counties in which marginalized communities exist.

Administration of the Fund: Sec. 18 of the PFM Act, 2012 Authorises The National Treasury is to administer the Fund and keep the Fund in a separate account maintained at the CBK. The National Treasury:

– Ensures that the Fund Account is not overdrawn at any time.

– Ensures that no funds are withdrawn without the approval of the Controller of Budget.

The approval, together with written instructions from the National Treasury requesting for the withdrawal, is sufficient authority for the CBK to pay amounts from the Fund.

Unutilized balances in the Fund at the end of the year remain in that Fund for use in the subsequent financial year.

COUNTY GOVERNMENT PUBLIC FUNDS;

COUNTY REVENUE FUND

There shall be established a Revenue Fund for each county government, into which shall be paid all money raised or received by or on behalf of the county government, except money reasonably excluded by an Act of Parliament.

Money may be withdrawn from the Revenue Fund of a county government only-

a) As a charge against the Revenue Fund that is provided for by an Act of Parliament or by legislation of the county; or

b) As authorised by an appropriation by legislation of the county.

Money shall not be withdrawn from a Revenue Fund unless the Controller of Budget has approved the withdrawal.

An Act of Parliament may–

(a) Make further provision for the withdrawal of funds from a county Revenue Fund; and

(b) Provide for the establishment of other funds by counties and the management of those funds.

COUNTY GOVERNMENT EMERGENCY FUNDS

A County Executive Committee may, with the approval of the County Assembly, establish an emergency fund for the county government under the name “County Emergency Fund”.

The County Emergency Fund should consist fund of money from time to time appropriated (authorised) by the county assembly to the Fund by appropriation law.

The purpose of the County Emergency Fund in Kenya is to enable payments to be made in respect of a county when an urgent and unforeseen need for expenditure arises for which there is no specific legislative authority.

The County Executive Committee member for finance should administer the county government Emergency Fund for the county government in accordance with a framework and criteria approved by the County Assembly.

The County Executive Committee member for finance should establish and maintain a separate (bank) account into which all money appropriated to the Emergency Fund should be paid.

The purpose of the County Emergency Fund in Kenya

The County Executive Committee member for finance may make payments from the county government’s Emergency Fund:

• Only if they are satisfied that there is an urgent and unforeseen need for expenditure for which there is no legislative authority, and

• Should be in accordance with operational guidelines made under regulations approved by Parliament and the law relating to disaster management.

There is an urgent and unforeseen event for expenditure if the County Executive Committee member for finance, guided by regulations and relevant laws, establishes that

1. Payment not budgeted for cannot be delayed until a later financial year without harming the general public interest;

2. Payment is meant to alleviate the damage, loss, hardship or suffering which may be caused directly by the event; and

3. The damage caused by the event is on a small scale and limited to the county.

The unforeseen event is one which –

• Threatens damage to human life or welfare; or

• Threatens damage to the environment.

The County Executive Committee member for finance may not, during a financial year, make a payment from the Emergency Fund exceeding two per cent of the total county government revenue as shown in that county government’s audited financial statements for the previous financial year, except for the first year.

The County Executive Committee member for finance should seek approval of the county assembly within two months after payment is made from the Emergency Fund.

COUNTY GOVERNMENT REVENUE SOURCES

The sources of revenue for county governments in Kenya are diverse. The county governments require revenue to implement their functions.

The sources of revenue for county governments in Kenya include revenue received from the national government, revenue generated locally, and revenue from external sources. ways in which the county governments raise their revenue are:

1. Equitable Share

The equitable share is the money parliament shares vertically between the national and the county governments. The money comes from the ordinary tax revenue the national government collects at the national level.

The Senate then allocates the equitable share for the counties (from the vertical share) horizontally among the 47 counties.

The equitable share is the biggest source of revenue for the county governments in Kenya.

The equitable share for the counties should not be less than fifteen per cent of all the revenue raised by the national government. The most recent audited revenues (by the Auditor General) approved by parliament should form the base for this threshold of 15 per cent.

The Senate uses a revenue-sharing formula developed by the Commission on Revenue Allocation (CRA) to divide the equitable share among the counties.

The equitable share allocated to the counties is unconditional. That is, the county governments can spend the money without any restrictions from the national government.

2. Own Source Revenue (OSR)

Article 209 (3) of the Kenyan Constitution empowers the county governments to impose two types of taxes and charges. These two sources of revenue for county governments in Kenya are property rates and entertainment taxes.

The county governments can also impose charges for any services they provide in accordance with the stipulated laws.

Some types of these own source revenue include (land) rates, single business permits, parking fees, building permits, and fees from billboards and advertisements.

The county governments impose their own source revenues through the Finance Act.

3. Conditional Grants

The county governments can receive additional allocations from the national government’s equitable share of revenue (from the vertical sharing). These additional allocations are known as conditional allocations or conditional grants.

They are conditional when the national government imposes restrictions on how county governments will spend them. They are unconditional when the national government does not impose any restrictions concerning their expenditure.

Most of these additional allocations are conditional allocations or grants. The county governments should spend them on specific items in the budget. They cannot divert them for other purposes.

For example, if a county receives a conditional grant for level five hospitals, it should not divert the money for other purposes other than these hospitals.

The conditional grants include the Equalization Fund that benefits certain areas that CRA recognizes and categorises as marginalised.

Other examples of conditional grants are money for Level Five hospitals (county referral hospitals), Compensation for user fees forgone (reimbursements for services county hospitals render) and Fuel Levy Fund (for maintaining county roads).

Conditional grants may come with other conditions. For example, a conditional grant may require that a county also put in “matching” funds.

For instance, a county may receive a grant for 75 per cent of the cost of some service, such as a hospital, and be expected to put in 25 per cent on its own. If it refuses, it may not receive the grant.

It is also important to note that not all counties receive some conditional grants. For example, only the counties with level five hospitals receive the regional grant for level five hospitals. In addition, only those areas recognized as marginalised using CRA’s criteria receive the Equalization Fund.

4. Loans

Loans as sources of revenue for county governments in Kenya may come from external sources or private lenders.

The external sources include foreign lenders such as multinational corporations (IMF, World Bank, etc.). The private lenders include commercial banks and other financial institutions.

The County Governments can borrow or access loans, which they repay with interest. However, the counties must meet two conditions in order to access the loans.

i. First, they can only access a loan if the national government guarantees the loan. That is, the national government should be willing to repay the loan if the county government is unable to repay.

ii. Second, the County Assembly must approve any loans that the county government intends to borrow.

The Kenyan Constitution mandates Parliament to come up with legislation to prescribe how the national government should guarantee loans.

The county governments should not borrow beyond the limits set by the County Assembly.

5. Donor Funding

Donor funding as a source of revenue for county governments in Kenya involves aid from international donors or development partners.

International donors or development partners provide aid in the form of loans and grants.

As with the national government, the international donors can also request counties to put in ‘matching funds’ to receive a grant.

Such international donors include:

• United States Agency for International Development (USAID);

• Danish International Development Agency (DANIDA); and

• United Kingdom’s Department For International Development (DFID).

The donors or development partners can send the money directly to the counties. These funds are usually in the form of conditional grants. They can also send grants to the counties through the national government ministries, departments and agencies (MDAs).

In the latter case, the MDAs manage the grants but disburse the money to county governments to implement the grants.

Apart from ‘matching’ the funds, the donors or development partners may have other requirements for the counties to qualify to receive the grants.

For example, they may require the counties to increase accountability mechanisms or improve the capacity of county staff in monitoring and expenditure of donor aid.

6. Investments

This is a minor source of revenue for county governments in Kenya. Counties can receive returns or profits from undertaking investments (return on investments). That is, the counties can invest in some resources and the resulting returns or profits become revenue for the county government.

Therefore, it is important for the counties to compare the efficiency of different investments before investing and also after investing (and receiving returns) to maximise revenue from this source.

I need the notes for public finance and taxation

I want you to email me the revision kit for Public Finance and Taxation and its Audio. The Revised version.