SomeaKenya provides Updated and Revised notes for the current CPA syllabus. Revision kits (Past papers with answers) are also available to help you with revision of the upcoming exams. You can get these materials in Hardcopies (Printed and Binded) and also available in Softcopy form when you subscribe on mobile or Desktop/Laptop someakenya Application. (Note: Softcopies are not Printable and can only be read using android phones) Click here to download SOMEAKENYA APP from Google Playstore.

Full Access to these notes/Kit on Desktop/Laptop via https://desktop.someakenya.co.ke

Or through Our Mobile App

Full Access to these notes/Kit on Desktop/Laptop via https://desktop.someakenya.co.ke

Or through Our Mobile App

CONTENT

11.1 Nature and purpose of cost and management accounting

– The nature of cost accounting and costing terms

– The role of cost accounting in management

– The purposes of cost accounting information

– Scope of cost accounting

– Meaning of management accounting, scope, limitations, applications

– Relationship between cost, financial and management accounting

– Selection of an ideal cost accounting system

11.2 Cost classification

– Definition and purpose of cost classification

– Methods of cost classification: by nature/elements of manufacturing costs; functional classification; behavioural classification; controllability; time; financial accounting; identification with inventory; for decision making

11.3 Cost estimation

– Meaning of cost estimation

– Methods of estimating cost; non-mathematical methods like engineering method, accounts analysis method and high-low method; mathematical methods like scatter graph method, OLS regression method (simple linear regression only)

11.4 Accounting, for material, labour and overheads

– Accounting for materials and inventory; material cost records, purchasing procedures, receipt and issues of material, methods of valuing material issues, inventory control procedures; economic order quantity (EOQ) and economic batch quantity(EBQ) models and back flush

– Accounting for labour: Methods of labour remuneration, labour control procedures, maintenance of labour records

– Accounting for overheads: Types of overheads, manufacturing, distribution and administration, service departmental cost allocation and apportionment, overheads analysis, overhead absorption rates, over or under absorption

11.5 Costing methods

– Job order costing

– Batch costing

– Process costing (including work in progress; joint and by-products)

– Service costing

– Unit costing

11.6 Marginal and absorption costing

– Distinction between marginal and absorption costing

– Valuation of products under marginal and absorption costing

– Preparation of marginal and absorption statements; cost of production and profit determination

– Applications of marginal costing: break-even analysis and charts (single product)

– Simplified decision problems; accept or reject, special order, dropping a product, make or buy

– Operating statements

11.7 Activity based costing

– Meaning of ABC

– Types of activities

– Overhead absorption rates

– Incomes statement

11.8 Budgeting and budgetary control

– Nature and purposes of budgets

– Preparation of budgets; master budgets, functional (department budgets, cash budgets), proforma financial reports (income statements and balance sheets)

– Purpose of budgetary control; operation of a budgetary control system, organisation and coordination of the budgeting function

– Distinction between budgeting and budgetary control in the private and public sectors

11.9 Standard costing

– Types of standards

– Principles of setting standards

– Standard cost card

– Behavioural aspects of standard costing

– Generation of standard cost information

– Materials, labour and overheads variances; price, efficiency mix and yield variances

TOPIC 1

THE CONTEXT OF MANAGEMENT ACCOUNTING

THE NATURE OF COST ACCOUNTING AND COSTING TERMS

Cost accounting is defined as, “That part of management accounting which establishes budgets and standard costs, and the actual costs of operations, processes, departments or products and the analysis of variances, profitability or social use of funds.”

Or

Cost Accounting is classifying, recording an appropriate allocation of expenditure for the determination of the costs of products or services, and for the presentation of suitably arranged data for the purpose of control and guidance of management

Costing: Costing is defined as the technique and process of ascertaining costs.

This involves participation in and with management to ensure that there is effective:

– Formulation of plans to meet objectives (long-term planning)

– Formulation of short-term operation plans (budgeting/profit planning)

– Corrective action to bring future actual transactions into line (financial control)

– Recording of actual transactions

Cost Accountancy: Cost Accountancy is defined as ‘the application of Costing and Cost Accounting principles, methods and techniques to the science, art and practice of cost control and the ascertainment of profitability’. It includes the presentation of information derived from there for the purposes of managerial decision making. Thus, Cost Accountancy is the science, art and practice of a Cost Accountant.

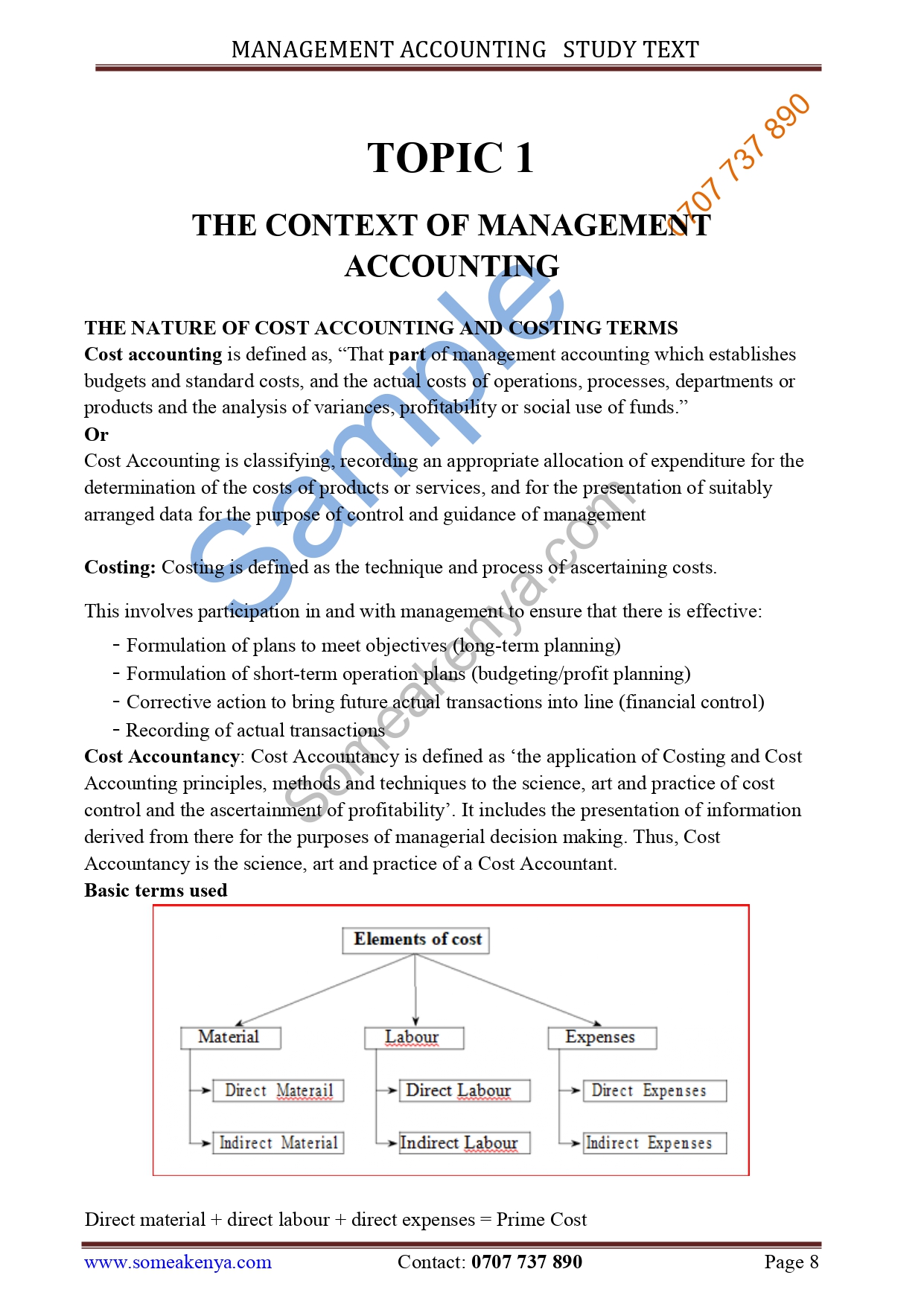

Basic terms used

Direct material + direct labour + direct expenses = Prime Cost

Indirect material + indirect labour + indirect expenses = Overheads

Direct Material Cost

Direct material cost can be defined as ‘The Cost of material which can be attributed to a cost object in an economically feasible way’. Direct materials are those materials which can be identified in the product and can be conveniently measured and directly charged to the product. Thus, these materials directly enter the product and form a part of the finished product. For example, timber in furniture making, cloth in dress making, bricks in building a house. The following are normally classified as direct materials:-

– All raw materials, like jute in the manufacture of gunny bags, pig iron in foundry and fruits in canning industry.

– Materials specifically purchased for a specific job, process or order, like glue for book binding, starch powder for dressing yarn.

– Parts or components purchased or produced, like batteries for transistor-radios.

– Primary packing materials like cartons, wrappings, card-board boxes, etc.

Indirect Material Cost

Materials, the costs of which cannot be directly attributed to a particular cost object. Indirect materials are those materials which do not normally form a part of the finished product. It has been defined as “materials which cannot be allocated but which can be apportioned to or absorbed by cost centres or cost units”. These are:

– Stores used in maintenance of machinery, buildings, etc., like lubricants, cotton waste, bricks and cements.

– Stores used by the service departments, i.e., non-productive departments like Power House, Boiler House and Canteen, etc., and

– Materials which due to their cost being small, are not considered worthwhile to be treated as direct materials.

Direct Labour / Employee Cost

The cost of employees which can be attributed to a cost object in an economically feasible way. In simple words, it is that labour which can be conveniently identified or attributed wholly to a particular job, product or process or expended in converting raw materials into finished goods. Wages of such labour are known as direct wages. Thus it includes payment made to the following groups of labour:

– Labour engaged on the actual production of the product or in carrying out of an operation or process.

– Labour engaged in adding the manufacture by way of supervision, maintenance, tool setting, transportation of material etc.

– Inspectors, analysts etc., specially required for such production.

Indirect Labour/ Employee Cost

The labour / employee cost which cannot be directly attributed to a particular cost object. The wages of that labour which cannot be allocated but which can be apportioned to or absorbed by cost centres or cost units is known as Indirect Labour. In other words, paid to labour which are employed other than on production constitute indirect labour costs. Example of such labour are: charge-hands and supervisors; maintenance workers; men employed in service departments, material handling and internal transport; apprentices, trainees and instructors; clerical staff and labour employed in time office and security office.

Direct or Chargeable Expenses

Direct expenses are expenses relating to manufacture of a product or rendering a service which can be identified or linked with the cost object other than direct material cost and direct employee cost. Direct expenses include all expenditure other than direct material or direct labour that is specifically incurred for a particular product or process. Such expenses are charged directly to the particular cost account concerned as part of the prime cost. Examples of direct expenses are:

1. Excise duty;

2. Royalty;

3. Architect or Supervisor’s fees;

4. Cost of rectifying defective work;

5. Travelling expenses to the city;

6. Experimental expenses of pilot projects;

7. Expenses of designing or drawings of patterns or models;

8. Repairs and maintenance of plant obtained on hire; and

9. Hire of special equipment obtained for a contract.

Overhead

Overheads comprise of indirect materials, indirect employee cost and indirect expenses which are not directly identifiable or allocable to a cost object. Overheads may defined as the aggregate of the cost of indirect material, indirect labour and such other expenses including services as cannot conveniently be charged directly to specific cost units. Thus overheads are all expenses other than direct expenses. In general terms, overheads comprise all expenses incurred for or in connection with, the general organization of the whole or part of the undertaking, i.e., the cost of operating supplies and services used by the undertaking and includes the maintenance of capital assets.

Prime Cost

The aggregate of direct material, direct labour and direct expenses. Generally it constitutes 50% to 80% of the total cost of the product, as such, as it is primary to the cost of the product and called Prime Cost.

Cost Object

Cost object is the technical name for a product or a service, a project, a department or any activity to which a cost relates. Therefore the term cost should always be linked with a cost object to be more meaningful. Establishing a relevant cost object is very crucial for a sound costing system. The Cost object could be defined broadly or narrowly. At a broader level a cost object may be named as a Cost Centre, whereas at a lowermost level it may be called as a Cost Unit.

Cost Centre

CIMA defines a cost centre as “a location, a person, or an item of equipment (or a group of them) in or connected with an undertaking, in relation to which costs ascertained and used for the purpose of cost control”. The determination of suitable cost centres as well as analysis of cost under cost centres is very helpful for periodical comparison and control of cost. In order to obtain the cost of product or service, expenses should be suitably segregated to cost centre. The manager of a cost centre is held responsible for control of cost of his cost centre. The selection of suitable cost centres or cost units for which costs are to be ascertained in an undertaking depends upon a number of factors such as organization of a factory, condition of incidence of cost, availability of information, requirements of costing and management policy regarding selecting a method from various choices. Cost centre may be production cost centres operating cost centres or process cost centres depending upon the situation and classification.

Cost centres are of two types-Personal and Impersonal Cost Centre. A personal cost centre consists of person or group of persons. An impersonal cost centre consists of a location or item of equipment or group of equipments.

In a manufacturing concern, the cost centres generally follow the pattern or layout of the departments or sections of the factory and accordingly, there are two main types of cost centres as below:-

(i) Production Cost Centre: These centres are engaged in production work i.e engaged in converting the raw material into finished product, for example Machine shop, welding shops…etc

(ii) Service Cost Centre: These centres are ancillary to and render service to production cost centres, for example Plant Maintenance, Administration…etc

The number of cost centres and the size of each vary from one undertaking to another and are dependent upon the expenditure involved and the requirements of the management for the purpose of control.

Responsibility Centre

A responsibility centre in Cost Accounting denotes a segment of a business organization for the activities of which responsibility is assigned to a specific person. Thus a factory may be split into a number of centres and a supervisor is assigned with the responsibility of each centre. All costs relating to the centre are collected and the Manager responsible for such a cost centres judged by reference to the activity levels achieved in relation to costs. Even an individual machine may be treated as responsibility centre for cost control and cost reduction.

Profit Centre

Profit centre is a segment of a business that is responsible for all the activities involved in the production and sales of products, systems and services. Thus a profit centre encompasses both costs that it incurs and revenue that it generates. Profit centres are created to delegate responsibility to individuals and measure their performance. In the concept of responsibility accounting, profit centres are sometimes also responsible for the investment made for the centre. The profit is related to the invested capital. Such a profit centre may also be termed as investment centre.

Cost Unit

Cost Unit is a device for the purpose of breaking up or separating costs into smaller sub divisions attributable to products or services. Cost unit can be defined as a ‘Unit of product or service in relation to which costs are ascertained’. The cost unit is the narrowest possible level of cost object.

It is the unit of quantity of product, service of time (or combination of these) in relation to which costs may be ascertained or expressed. We may, for instance, determine service cost per tonne of steel, per tonne-kilometre of a transport service or per machine hour. Sometimes, a single order or contract constitutes a cost unit which is known as a job. A batch which consists of a group of identical items and maintains its identity through one or more stages or production may also be taken as a cost unit.

A few examples of cost units are given below:

Industry / Product Cost Unit

Automobile Number of vehicles

Cable Metres / kilometres

Cement Tonne

Chemicals / Fertilizers Litre / Kilogram / tonne

Gas Cubic Metre

Power – Electricity Kilowatt Hour

Transport Tonne-Kilometre, Passenger-Kilometre

Hospital Patient per Day

Hotel Bed per Night

Education Student per year

Telecom Number of Calls

Professional Service Chargeable Hours

Cost Allocation

When items of cost are identifiable directly with some products or departments such costs are charged to such cost centres. This process is known as cost allocation. Wages paid to workers of service department can be allocated to the particular department. Indirect materials used by a particular department can also be allocated to the department. Cost allocation calls for two basic factors – (i) Concerned department/product should have caused the cost to be incurred, and (ii) exact amount of cost should be computable.

Cost Apportionment

When items of cost cannot directly charge to or accurately identifiable with any cost centres, they are prorated or distributed amongst the cost centres on some predetermined basis. This method is known as cost apportionment. Thus we see that items of indirect costs residual to the process of cost allocation are covered by cost apportionment. The predetermination of suitable basis of apportionment is very important and usually following principles are adopted – (i) Service or use (ii) Survey method (iii) Ability to bear. The basis ultimately adopted should ensure an equitable share of common expenses for the cost centres and the basis once adopted should be reviewed at periodic intervals to improve upon the accuracy of apportionment.

Cost Absorption

Ultimately the indirect costs or overhead as they are commonly known, will have to be distributed over the final products so that the charge is complete. This process is known as cost absorption, meaning thereby that the costs absorbed by the production during the period. Usually any of the following methods are adopted for cost absorption – (i) Direct Material Cost Percentage (ii) Direct Labour Cost Percentage (iii) Prime Cost Percentage (iv) Direct Labour Hour Rate Method (v) Machine Hour Rate, etc. The basis should be selected after careful maximum accuracy of Cost Distribution to various production units. The basis should be reviewed periodically and corrective action whatever needed should be taken for improving upon the accuracy of the absorption.

Conversion Cost

This term is defined as the sum of direct wages, direct expenses and overhead costs of converting raw material to the finished products or converting a material from one stage of production to another stage. In other words, it means the total cost of producing an article less the cost of direct materials used. The cost of indirect materials and consumable stores are included in such cost. The compilation of conversion cost is useful in a number of cases. Where cost of direct materials is of fluctuating nature, conversion cost is used to cost control purpose or for any other decision making. In contracts/jobs where raw materials are on account of the buyer’s conversion cost takes the place of total cost in the books of the producer. Periodic comparison/review of the conversion cost may give sufficient insight as to the level of efficiency with which the production unit is operating.

Cost Control

Cost Control is defined as the regulation by executive action of the costs of operating an undertaking, particularly where such action is guided by Cost Accounting.

Cost control involves the following steps and covers the various facets of the management:

1. Planning: First step in cost control is establishing plans / targets. The plan/target may be in the form of budgets, standards, estimates and even past actual may be expressed in physical as well as monetary terms. These serves as yardsticks by which the planned objective can be assessed.

2. Communication: The plan and the policy laid down by the management are made known to all those responsible for carrying them out. Communication is established in two directions; directives are issued by higher level of management to the lower level for compliance and the lower level executives report performances to the higher level.

3. Motivation: The plan is given effect to and performances starts. The performance is evaluated, costs are ascertained and information about results achieved are collected and reported. The fact that costs are being complied for measuring performances acts as a motivating force and makes individuals endeavor to better their performances.

4. Appraisal and Reporting: The actual performance is compared with the predetermined plan and variances, i.e deviations from the plan are analyzed as to their causes. The variances are reported to the proper level of management.

5. Decision Making: The variances are reviewed and decisions taken. Corrective actions and remedial measures or revision of the target, as required, are taken.

Advantages of Cost Control

The advantages of cost control are mainly as follows

1. Achieving the expected return on capital employed by maximising or optimizing profit

2. Increase in productivity of the available resources

3. Reasonable price of the customers

4. Continued employment and job opportunity for the workers

5. Economic use of limited resources of production

6. Increased credit worthiness

7. Prosperity and economic stability of the industry

Cost Reduction

Profit is the resultant of two varying factors, viz., sales and cost. The wider the gap between these two factors, the larger is the profit. Thus, profit can be maximised either by increasing sales or by reducing costs. In a competition less market or in case of monopoly products, it may perhaps be possible to increase price to earn more profits and the need for reducing costs may not be felt. Such conditions cannot, however, exist paramount and when competition comes into play, it may not be possible to increase the sale price without having its adverse effect on the sale volume, which, in turn, reduces profit. Besides, increase in price of products has the ultimate effect of pushing up the raw material prices, wages of employees and other expenses- all of which tend to increase costs. In the long run, substitute products may come up in the market, resulting in loss of business. Avenues have, therefore, to be explored and method devised to cut down expenditure and thereby reduce the cost of products. In short, cost reduction would mean maximization of profits by reducing cost through economics and savings in costs of manufacture, administration, selling and distribution.

Cost reduction may be defined as the real and permanent reduction in the unit costs of goods manufactured or services rendered without impairing their suitability for the use intended. As will be seen from the definition, the reduction in costs should be real and permanent. Reductions due to windfalls, fortuities receipts, changes in government policy like reduction in taxes or duties, or due to temporary measures taken for tiding over the financial difficulties do not strictly come under the purview of cost reduction. At the same time a programme of cost reduction should in no way affect the quality of the products nor should it lower the standards of performance of the business.

Broadly speaking reduction in cost per unit of production may be affected in two ways viz.,

1. By reducing expenditure, the volume of output remaining constant, and

2. By increasing productivity, i.e., by increasing volume of output and the level of expenditure remains unchanged.

These aspects of cost reduction are closely linked and they act together – there may be a reduction in the expenditure and the same time, an increase in productivity.

The objectives of cost accounting in management

The following are the main objectives of Cost Accounting:-

1. To ascertain the Costs under different situations using different techniques and systems of costing.

2. To determine the selling prices under different circumstances.

3. To determine and control efficiency by setting standards for Materials, Labour and Overheads.

4. To determine the value of closing inventory for preparing financial statements of the concern.

5. To provide a basis for operating policies which may be determination of Cost Volume relationship, whether to close or operate at a loss, whether to manufacture or buy from market, whether to continue the existing method of production or to replace it by a more improved method of production etc

Scope of Cost Accounting

The scope of Cost Accountancy is very wide and includes the following:-

1. Cost Ascertainment: The main objective of Cost Accounting is to find out the Cost of product / services rendered with reasonable degree of accuracy.

2. Cost Accounting: It is the process of Accounting for Cost which begins with recording of expenditure and ends with preparation of statistical data.

3. Cost Control: It is the process of regulating the action so as to keep the element of cost within the set parameters.

4. Cost Reports: This is the ultimate function of Cost Accounting. These reports are primarily prepared for use by the management at different levels. Cost reports helps in planning and control, performance appraisal and managerial decision making.

5. Cost Audit: Cost Audit is the verification of correctness of Cost Accounts and check on the adherence to the Cost Accounting plan. Its purpose is not only to ensure the arithmetic accuracy of cost records but also to see the principles and rules have been applied correctly.

Management Accounting

The Certified Institute of Management Accountants (CIMA) of UK defines the term ‘Management Accounting’ in the following manner:

“Management Accounting is an integral part of management concerned with identifying, presenting and interpreting information for:

1. Formulating strategy

2. Planning and controlling activities

3. Decision taking

4. Optimizing the use of resources

5. Disclosure to shareholders and others, external to the entity

6. Disclosure to employees

7. Safeguarding assets”

From the above definitions, it is clear that the management accounting is concerned with that accounting information, which is useful to the management. The accounting information is rearranged in such a manner and provided to the top management for effective control to achieve the goals of business. Thus, management accounting is concerned with data collection from internal and external sources, analyzing, processing, interpreting and communicating information for use, within the organization, so that management can more effectively plan, make decisions and control operations. The information to be collected and analysed has been extended to its competitors in the industry. This provides more meaningful clues for proper decision-making in the right direction.

The information in the management accounting system is used for three different purposes:

1. Measurement

2. Control and

3. Decision-making 1.okonnlnn,

Significance of management accounting

The various advantages that accrue out of management accounting are enumerated below:

a) Delegation of Authority: Now a day the function of management is no longer personal, management accounting helps the organisation in proper delegation of authority for the attainment of the vision and mission of the business.

b) Need of the Management: Management Accounting plays the role in meeting the need of the management

c) Qualitative Information: Management Accounting accumulates the qualitative information so that management would concentrate on the actual issue to deliberate and attain the specific conclusion even for the complex problem.

d) Objective of the Business: Management Accounting provides measure and reports to the management thereby facilitating in attainment of the objective of the business.

Users of management accounting information

Managerial accounting focuses on internal users—executives, product managers, sales managers, and any other personnel within the organization who use accounting information to make important decisions. Managerial accounting information need not conform with U.S. GAAP. In fact, conformance with U.S. GAAP may be a deterrent to getting useful information for internal decision-making purposes. For example, when establishing an inventory cost for one or more units of product (each jersey or hat produced at Sportswear Company), U.S. GAAP requires that production overhead costs, such as factory rent and factory utility costs, be included. However, for internal decision-making purposes, it might make more sense to include nonproduction costs that are directly linked to the product, such as sales commissions or administrative costs.

Functions of management accounting

The primary objective of Management Accounting is to maximize profits or minimize losses. This is done through the presentation of statements in such a way that the management is able to take corrective policy or decision. The manner in which the Management Accountant satisfies the various needs of management is described as follows:

(1) Storehouse of Reliable Data: Management wants reliable data for Planning, Forecasting and Decision-making.

Management accounting collects the data from various sources and stores the information for appropriate use, as and when needed. Though the main source of data is financial statements, Management Accounting is not restricted to the use of monetary data only. While preparing a sales budget, the management accountant uses the past data of the products sold from the financial records and makes projections based on the consumer surveys, population figures and other reliable information to estimate the sales budget. So, management accounting uses qualitative information, unlike financial accounting, for preparing its reports, collecting and modifying the data for the specific purpose.

(2) Modification and Presentation of Data: Data collected from financial statements and other sources is not readily understandable to the management. The data is modified and presented to the management in such a way that it is useful to the management. If sales data is required, it can be classified according to product, geographical area, season-wise, type of customers and time taken by them for making payments. Similarly, if production figures are needed, these can be classified according to product, quality, and time taken for manufacturing process. Management Accountant modifies the data according to the requirements of the management for each specific issue to be resolved.

(3) Communication and Coordination: Targets are communicated to the different departments for their achievement. Coordination among the different departments is essential for the success of the organisation.

The targets and performances of different departments are communicated to the concerned departments to increase the efficiency of the various sections, thereby increasing the profitability of the firm. Variance analysis is an important tool to bring the necessary matters to the attention of the concerned to exercise control and achieve the desired results.

(4) Financial Analysis and Interpretation: Management accounting helps in strategic decision making. Top managerial executives may lack technical knowledge. For example, there are various alternatives to produce.

There is always a choice for the sales mix. Management 344 Accounting for Managers Accountant gives facts and figures about various policies and evaluates them in monetary terms. He interprets the data and gives his opinion about various alternative courses of action so that it becomes easier to the management to take a decision.

(5) Control: It is absolutely essential that there should be a system of monitoring the performance of all divisions and departments so that deviations from the desired path are brought to light, without delay and are corrected then and there. This process is termed as control. The aim of this function ‘control’ is to facilitate accomplishment of the goals in an efficient manner. For the discharge of this important function, management accounting provides meaningful information in a systematic and effective manner. However, the role of accountant is misunderstood. Many consider the accountant as a controller of their performance.

Many accountants themselves misunderstand their own role as controllers. The real role of control is effective communication and assists the managers in achieving their goals, as efficiently as possible.

(6) Supplying Information to Various Levels of Management: Every level of management requires information for decision-making and policy execution. Top-level management takes broad policy decisions, leaving day-to-day decisions to lower management for execution. Supply of right information, at proper time, increases efficiency at all levels.

(7) Reporting to Management: Reporting is an important function of management accounting to achieve the targets. The reports are presented in the form of graphs, diagrams and other statistical techniques so as to make them easily understandable. These reports may be monthly, quarterly, and half-yearly. These reports are helpful in giving constant review of the working of the business.

– Storehouse of Reliable Data Modification and Presentation of Data

– Financial Analysis and Interpretation

– Communication and Coordination

– Control

– Reporting to Management

– Supplying Information to Various Levels of Management

1.6 LIMITATIONS OF MANAGEMENT ACCOUNTING

Despite the development of Management Accounting as an effective discipline to improve the managerial performance, some of the limitations are as under:

(1) Accuracy is not ensured: Management Accounting is largely based on estimates. It does not deal with actual, alone, and thus total accuracy is not ensured under Management Accounting.

(2) A tool in the hands of management: Management Accounting is definitely a tool in the hands of management, but cannot replace management.

(3) Strength and weakness: Management Accounting derives information from Financial Accounting, Cost Accounting and other records. The strength and weakness of these basic information providers become the strength and weakness of Management Accounting too.

(4) Costly affair: The installation of Management Accounting is a costly affair so all the organizations, in particular small firms cannot afford.

(5) Lack of knowledge and understanding: The emergence of Management Accounting is the fusion of a number of subjects like statistics, economics, engineering and management theory. Any inadequate grounding in any one or more of the subjects is bound to have an unfavourable effect on the consideration and solution of the problems, relating to management performance.

(6) Evolutionary Stage: Comparatively, Management Accounting is a new discipline and is still very much in a stage of evolution. Therefore, it comes across the same difficulties or obstacles, which a relatively new discipline has to face.

(7) Psychological resistance: Adoption of a system of Management Accounting brings about a radical change in the established pattern of the activity of the management personnel. It calls for rearrangement of personnel as well as their activities. This is bound to encounter opposition from some quarter or other.

1.7 TIONSHIP BETWEEN MANAGEMENT ACCOUNTING AND COST ACCN A

Relationship between Management Accounting and Cost Accounting:

Management Accounting is primarily concerned with the requirements of the management. It involves application of appropriate techniques and concepts, which help management in establishing a plan for reasonable economic objective. It helps in making rational decisions for accomplishment of management objectives. Any workable concept or techniques whether it is drawn from Cost Accounting, Financial Accounting, Economics, Mathematics and statistics, can be used in Management Accountancy. The data used in Management Accountancy should satisfy only one broad test. It should serve the purpose that it is intended for. A management accountant accumulates, summarises and analysis the available data and presents it in relation to specific problems, decisions and day-to-day task of management. A management accountant reviews all the decisions and analysis from management’s point of view to determine how these decisions and analysis contribute to overall organisational objectives. A management accountant judges the relevance and adequacy of available data from management’s point of view.

The scope of Management Accounting is broader than the scope of Cost Accountancy. In Cost Accounting, primary emphasis is on cost and it deals with its collection, analysis, relevance interpretation and presentation for various problems of management. Management Accountancy utilizes the principles and practices of Financial Accounting and Cost Accounting in addition to other management techniques for efficient operations of a company. It widely uses different techniques from various branches of knowledge like Statistics, Mathematics, Economics, Laws and Psychology to assist the management in its task of maximising profits or minimizing losses. The main thrust in Management Accountancy is towards determining policy and formulating plans to achieve desired objective of management. Management Accountancy makes corporate planning and strategy effective. From the above discussion we may conclude that the Cost Accounting and Management Accounting are interdependent, greatly related and inseparable.

Financial Accounting and Cost Accounting

Financial Accounting is primarily concerned with the preparation of financial statements, which summarise the results of operations for selected period of time and show the financial position of the company at particular dates. In other words, Financial Accounting reports on the resources available (Balance Sheet) and what has been accomplished with these resources (Profit and Loss Account). Financial Accounting is mainly concerned with requirements of creditors, shareholders, government, prospective investors and persons outside the management. Financial Accounting is mostly concerned with external reporting.

Cost Accounting, as the name implies, is primarily concerned with determination of cost of something, which may be a product, service, a process or an operation according to costing objective of management. A Cost Accountant is primarily charged with the responsibility of providing cost data for whatever purposes they may be required for. Summary is shown below:

Management accounting and financial accounting

As we have discussed, the basic meaning of the two types of accounting, let’s understand the difference between financial accounting and management accounting:

1. Financial Accounting is a discipline that deals with the preparation of financial statements, and communication of the information to the users. As against, management accounting is all about the provision of information that is useful to the management, to assist the management in the formulation of policies and day to day operations for efficient operation of the business.

2. Financial Accounting uses the monetary records of past financial activities, so it is historically oriented. As against, management accounting is future-oriented, as it provides both present and future information in the form of forecasts and budgets which are duly analysed and presented in a detailed manner, so as to act as a base for management decision making.

3. Financial Accounting reports only those events which can be described in monetary terms, but non-monetary events which have a positive or negative impact on the company’s success or failure are completely ignored. Conversely, management accounting records and reports both financial and non-financial events, for better decision making. Measures like a number of employees. labour hours, machine hours and product units are also important for analysis and decision making.

4. In financial accounting, the reports prepared are mainly used by external users, but internal users also use them. It reflects how the business enterprise uses resources during a particular period of time. External users use it for decision-making purposes. However, it is the members of management who use the reports generated under management accounting.

5. For the purpose of recording, classifying, summarizing and reporting business transactions, in financial accounting. Generally Accepted Accounting Principles (GAAPs) are used. Conversely, in the case of management accounting, there is no such compulsion of using Generally Accepted Accounting Principles (GAAPs).

6. Financial Accounting generates information and reports that are public in nature. These are general purpose financial statements that serve the informational needs of multiple users. It keeps a track of the financial performance of the entire firm and not just of an individual segment or department. As against, in management accounting reports are prepared for private use by the company’s management and so they are confidential. These are specific purpose reports and are meant to determine the performance of entities, product lines and departments. Data produced comprise facts, estimates, analysis forecasts, budgets etc.

7. Financial Accounting looks at the big picture, as it looks at the business as a whole. As against, management accounting looks at business in segments, commonly known as responsibility centres.

8. Maintenance of records and preparation of the periodical financial statements, as per the financial accounting system is compulsory. In contrast, management accounting is optional.

Similarities

• Both are a part of the basic accounting system.

• The two systems keeps a track of economic events.

• The two aim at quantifying the outcome of economic activities and transactions.

• Preparation of reports uses the same database.

• Evaluate the performance and position of the enterprise.

Difference between Financial Accounting & Cost Accounting

– Users of the information – Financial accounting information is used by external parties as well as internally by managers. Cost Accounting information is used internally by managers.

– Compliance with GAAP – Financial Accounting statements are prepared in compliance with GAAP (Generally Accepted Accounting Principles) whereas cost accounting statements do not need to comply with any principles.

– Format – Financial Accounting statements are prepared in the format presented by the (IAS) International Accounting Standards whereas Cost Accounting statements are prepared in the format internally decided by the management.

– Periodicity of Reporting – Financial Accounting reports are issued periodically e.g. annually, semi-annually etc. Cost Accounting reports can be prepared when the management requires them.

– Audit Requirements – Financial Accounts should be audited by an external or independent party. Cost Accounts needs not be audited unless they contain vital information for the audit.

– Legal Requirement – Financial Accounting reports are compulsory by law (under CAP 486). Cost Accounting reports are prepared when management require them.

– Sources of Information – Data used to prepare financial statement is historical by nature i.e. based on past transactions. Cost Accounting uses historical, current and sometimes future data to prepare its statement.

– Precision – Financial Accounting requires accurate information otherwise external parties will not have confidence in the content of the report. Cost Accounting may allow for approximation of certain information required.

– Unit of Measurement – All information under Financial Accounting is in terms of money value. Cost Accounting applies any unit of measurement that is useful in a given situation e.g. Labour hours, output, machine hours etc

Advantages of Cost Accounting

Cost Accounting has manifold advantages, a summary of which is given below. It is not suggested that having installed a system of Cost Accounting, a concern will expect to derive all the benefits stated here, the nature and the extent of the advantages obtained will depend upon the type, adequacy and efficiency of the cost system installed and the extent to which the various levels of management are prepared to accept and act upon the advice rendered by the cost system.

The Cost Accounting System has the following advantages:-

1. A cost system reveals unprofitable activities, losses or inefficiencies occurring in any form such as:

a) Wastage of man power, idle time and lost time.

b) Wastage of material in the form of spoilage, excessive scrap etc., and

c) Wastage of resources, e.g. inadequate utilization of plant, machinery and other facilities.

2. Cost Accounting locates the exact causes for decrease or increase in the profit or loss of the business. It identifies the unprofitable products or product lines so that these may be eliminated or alternative measures may be taken.

3. Cost Accounts furnish suitable data and information to the management to serve as guides in making decisions involving financial considerations.

4. Cost Accounting is useful for price fixation purposes. Although sale price is generally related more to economic conditions prevailing in the market than to cost, the latter serves as a guide to test the adequacy of selling prices.

5. With the application of Standard Costing and Budgetary Control methods, the optimum level of efficiency is set.

6. Cost comparison helps in cost control. Comparison may be period to period, of the figures in respect of the same unit or factory or of several units in an industry by employing Uniform Costs and Inter- Firm Comparison methods. Comparison may be made in respect of cost of jobs, process or cost centres.

7. A cost system provides ready figures for use by the Government, wage tribunals and boards, and labour and trade unions.

8. When a concern is not working to full capacity due to various reasons such as shortage of demands or bottlenecks in production, the cost of idle capacity can readily worked out and repealed to the management.

9. Introduction of a cost reduction programme combined with operations research and value analysis techniques leads to economy.

10. Marginal Costing is employed for suggesting courses of action to be taken. It is a useful tool for the management for making decisions.

11. Determination of cost centres or responsibility centres to meet the needs of a Cost Accounting system, ensures that the organizational structure of the concern has been properly laid responsibility can be properly defined and fixed on individuals.

12. Perpetual inventory system which includes a procedure for continuous stock taking is an essential feature of a cost system.

13. The operation of a system of cost audit in the organization prevents manipulation and fraud and assists in furnishing correct and reliable cost data to the management as well as to outside parties like shareholders, the consumers and the Government.

Limitations of Cost Accounting system

Like any other system of accounting, Cost Accountancy is not an exact science but an art which has developed through theories and accounting practices based on reasoning and commonsense. Many of the theories cannot be proved nor can they be disproved. They grownup in course of time to become conventions and accepted principles of Cost Accounting. These principles are by no means static, they are changing from day to day and what is correct today may not hold true in the circumstances tomorrow.

Large number of Conventions, Estimates and Flexible factors: No cost can be said to be exact as they incorporate a large number of conventions, estimations and flexible factors such as:-

a) Classification of costs into its elements.

b) Materials issue pricing based on average or standard costs.

c) Apportionment of overhead expenses and their allocation to cost units/centres.

d) Arbitrary allocation of joint costs.

e) Division of overheads into fixed and variable.

Cost Accounting lacks the uniform procedures and formats in preparing the cost information of a product/ service. Keeping in view this limitation, all Cost Accounting results can be taken as mere estimates.

ACCOUNTING

Selection of an ideal cost accounting system

A system is a set of interdependent parts, which together form a unitary whole that performs certain functions. A number of sub systems make up the whole. In this context of an organization, a management information system may be seen as the overall system with a number of subsystems including the cost and management accounting system that provide the information to management for purposes of planning, organizing, directing and controlling the organization’s activities so as to achieve corporate goals, including profit maximization.

A number of features and factors must be taken into account when designing a cost and management accounting system. These are:

1. Preliminary investigations must be made before a system is installed. This helps to disclose weaknesses and inefficiencies.

2. For accuracy of cost records, a system of material cost, labour cost and production overheads cost is essential

3. Nature of the business enterprise must be put into consideration when designing the cost accounting system. The system developed should be practical and must suit the business

4. The system should be cost effective in that the benefits derived from the system must be greater than the cost of running it.

15S T U D Y T E X T

The following factors must be taken into account before finalizing the cost accounting

system design

1. The system must be designed in such a way as to meet the managerial information needs. There should be no duplication in reporting. Only relevant management information should be provided. Information is relevant if it has an impact on the decision made by the management.

2. The factory layout and production sequence. This is important for the identification of the sequence of production i.e. the starting and the ending points.

3. Control exercised over production; the cost data must focus on specific areas of control so that the responsibility of any variances between the actual and the standard costs can be identified with an individual manager or department.

4. Nature of raw materials used affect the system adopted. This is because it affects the recording and issuance of raw materials and the method of pricing

5. The deployment of workers, who may work as a team or as individuals. This affects the method of remuneration and the analysis of time worked. For instance, where employees work as a team, there may be group bonus awards, which do not exist in situations where employees work individually.

6. Key personnel and office staff; their cooperation is vital for the success of the system. In addition, the system needs to be simple and easy to understand to enhance acceptability

7. Relative size of cost element; it is only reasonable to analyze cost elements with a significant value. Cost elements of insignificant value may be left out of the analysis depending on the composition of the cost items

8. Need for uniformity; a business needs to observe the industrial norms and thus follow the industrial practices as regards the accounting. If the business, for instance, belongs to a trade association, it will need to follow the association’s recommendation on cost accounting principles and in order to facilitate comparison of its data with that of other businesses in the industry.

9. The cost benefit analysis should be carried out and it is only reasonable to run a system whose benefits are more than the costs incurred in terms of money, time spent in designing, installing, testing, running and maintaining the cost accounting system.

10. The system should be capable of adapting to changing conditions. It should be logical and simple. Flexibility is vital to any accounting system bearing in mind that the organization exists in an open system. It is only a subsystem of a larger system.

11. Periodical upgrade of the system is crucial to avoid the danger of going obsolete as the world is rapidly changing.

SELF EXAMINATION QUESTIONS

1. Describe four shortcomings of cost accounting

2. Describe five ways in which cost accounting complements financial accounting in terms of providing information to managers for batter decision making

3. Cost accounting is often described as “the provision of information required by management for specific purposes”

Required

State six of these specific purposes

the notes are not complete. it does not have page 133-165

Hello Mercy, This is a sample. we have only displayed a few pages. For complete notes you only access them after buying.